U

SER

’

S

G

UIDE

— 59

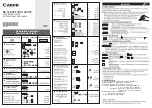

Calculating Tax and Insurance Percent or Dollar Amount

If loan variables are entered in addition to tax and insurance percent

rates or dollar values, the respective Tax/Insurance dollar values or

percent rates can be viewed by simply pressing the applicable keys a

second time. For example, enter an annual property tax rate of 1.5%,

a property insurance rate of 0.25% and a mortgage insurance rate of

0.75%. Then enter a sales price of $250,000, 25% down, a term of

30 years and an interest rate of 8%. Calculate the loan, monthly pay-

ments and annual tax and insurance dollar amounts, or premiums.

STEPS

KEYSTROKES

DISPLAY

Clear calculator

o o

0.00

Set Property Tax rate

1 • 5 t

1.50

Set Insurance rate

• 2 5 s t

0.25

Set Mortgage Ins. rate

• 7 5 s 9

0.75

Enter Price

2 5 0 ) P

250,000.00

Enter Down Payment %

2 5 d

25.00

Enter Term in years

3 0 T

30.00

Enter annual Interest rate

8 ˆ

8.00

Find Mortgage Amount

l

187,500.00

Recall property Tax %

® t

1.50

Calculate property Tax $

t

3,750.00

Recall property Ins. %

® s t

0.25

Calculate property Ins. $

s t

625.00

Recall Mortgage Ins. %

® s 9

0.75

Calculate Mortgage Ins. $

s 9

1,406.25

Find monthly P&I Payment

p

“run” 1,375.81

Find monthly PITI Payment

p

“run” 1,857.58

Note: The same procedure can be performed to find the opposite — that is, find the

respective % rates based on entered annual dollar amounts or insurance premiums.

Simply enter the dollar amounts and mortgage variables first, and the second press

of the respective key will calculate the percent rate.