40

Sign (+/-) and tax status

For each PLU

For a range of PLUs

*1,2,3: 1 through 999999

*4

: Item:

Selection:

Entry:

A

Sign (+/-)

Minus PLU

1

Plus PLU

0

B

VAT6 or TAX6

Yes

1

No

0

C

VAT5 or TAX5

Yes

1

No

0

D

VAT4 or TAX4

Yes

1

No

0

E

VAT3 or TAX3

Yes

1

No

0

F

VAT2 or TAX2

Yes

1

No

0

G

VAT1 or TAX1

Yes

1

No

0

• The tax system of your machine has been factory–set to automatic VAT1–6. If you desire to

select any of automatic tax 1–6, manual VAT1–6, manual VAT1, manual tax 1–6, and the

combination of the automatic VAT 1–3 and the automatic tax 4–6, consult your dealer.

• When the combination of the automatic VAT1–3 and automatic tax 4–6 system is selected, one of

the VAT1(G), VAT2(F) and VAT3(E) can be selected in combination with tax 4–6.

Example: BCDEFG= 100100, 110100, 111010

• A PLU not programmed for any of these tax statuses is registered depending on the tax status of

the department which the PLU belongs to.

Note

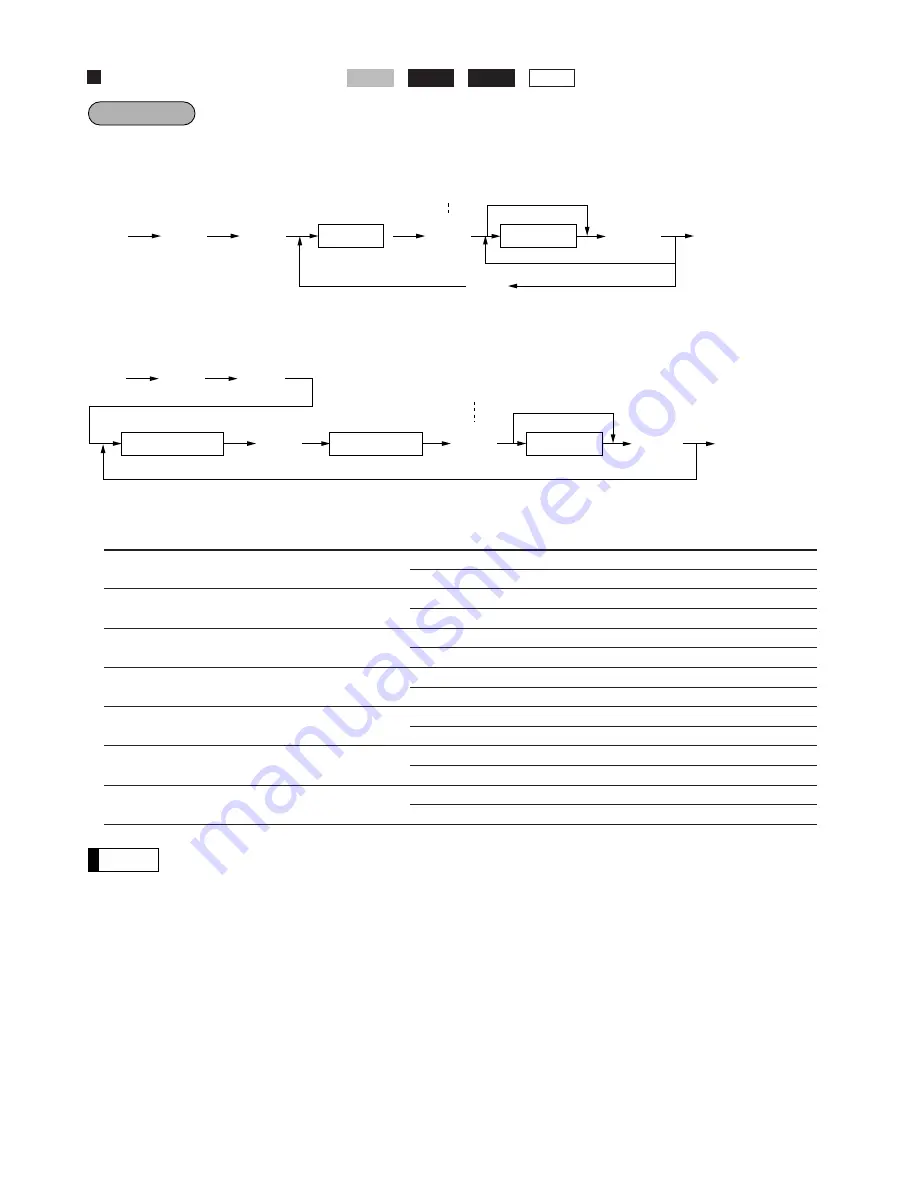

2232

.

≈

≈

≈

:

;

Start PLU code

End PLU code

* 2

* 3

To apply the current setting of start

PLU code to PLUs within the range

A B C D E F G

* 4

The current setting

of start PLU code

is displayed.

2211

.

≈

≈

:

;

PLU code

To keep the current setting

* 1

c

The current

setting

is displayed.

A B C D E F G

* 4

Procedure

Direct

2232

2211

PGM 2